Help Buying a Home for Low Income Families

Paths to Homeownership for Depression-Income and Minority Households

Highlights

- Creditworthy low-income and minority families face pregnant barriers to sustainable homeownership, a major vehicle for building wealth and economic opportunity.

- Admission to sustainable homeownership is expanded with fiscal assistance, housing counseling, sound lending, flexible underwriting that ensures the ability to pay, and backing by FHA's mortgage insurance.

- Efforts to make homeownership attainable to depression-income and minority households ultimately depend on economic recovery, a healthy housing market, and increased protections for consumers, investors, and taxpayers.

Homeownership is in the nation'due south interest when it brings stability to families, vitality to distressed communities, and overall economic growth. Sage Computing The current economic environment, characterized past slow growth, eroded household net worth, strict lending standards, and tight credit, presents sobering challenges to would-be homeowners, particularly if they earn low incomes or belong to a racial or ethnic minority. Renter households have seen their incomes fall and rents increase since the economic downturn, and the number of renters amidst the severely housing cost-encumbered has risen.1 Although business firm prices and involvement rates have declined, purchasing a dwelling house is out of reach for many of these families because they have insufficient cash for down payment and closing costs, cannot pay down debts, have low credit scores, and are subject to college borrowing costs.ii For American families, who typically borrow to purchase homes, access to credit represents opportunity and financial security. In the wake of the housing crisis and the resulting fasten in foreclosures, however, credit is extremely hard to obtain and is probable to remain so for some fourth dimension.3

Because depression-income and minority families are especially vulnerable financially in a mail service-recession, mail-housing crisis era, stakeholders have questioned whether homeownership remains a reliable wealth-building vehicle for these households. The respond to this question depends on a number of factors that influence wealth aggregating, including household income, duration of ownership, time of buy in relation to market performance, domicile characteristics (such as condition, historic period, location, and type of structure) that impact upkeep costs and rate of appreciation, and the terms of the mortgage.4

Households with few resources have express avenues for developing a sound economic base on which to build their time to come. Therefore, policymakers working to prevent another housing crisis must take care to not disproportionately burden families who are able to realize the benefits of homeownership, the largest source of household wealth in the United states of america.5 Housing policy analysts are reexamining assumptions about the best style to brand homeownership viable and sustainable to depression-income and minority families. As Alan Mallach of the Brookings Institution stresses, growing the number of depression-income homeowners is not enough; policymakers must prefer measures that will "foster a sustainable model of homeownership for lower-income households."6 With the aftermath of the recession and housing crisis yet very much present, this article examines the importance — and challenges — of depression-income and minority homeownership.

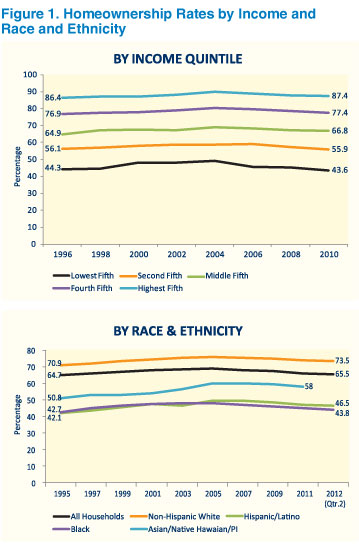

Recent homeownership rates show that 73.v percentage of owners are white, while African-American and Hispanic homeownership rates remain below fifty percent. Similarly, the homeownership rate for households with very depression incomes was 43.viii percentage points beneath the charge per unit for loftier-income households (figure one). These are long-standing differences. Since the 1980s, federal policies take eased the path to homeownership for low-income and minority families, which potentially benefits both individual households and gild at big by countering poverty.7 Homeownership contributes to fiscal security and stability by offer homeowners protection from rising housing costs, increased savings and purchasing power, the power to infringe against the equity of the home, and the opportunity to refinance at lower interest rates. Such benefits are not guaranteed, all the same, and every bit Christopher Herbert and Eric Belsky's review and synthesis of the research notes, homeownership should exist viewed as "an investment that carries with it significant risks and uncertainties. For any number of reasons, homeowners can end upwardly losing money on their homes or earn less of a render than if they had rented over some catamenia."viii The recent recession and outburst of the housing bubble provide a clear case of this hazard; real internet household wealth cruel by 57 percent from 2006 to 2011. This decline hit low-income and minority households peculiarly difficult because dwelling disinterestedness accounts for a larger share of their wealth.9 This impact is poignantly illustrated in the Chicago metropolitan area, where six counties are suffering from particularly high foreclosure rates and declines in home values in the aftermath of the housing crisis. In these counties, negative home equity was disproportionately concentrated in depression-wealth, minority neighborhoods, where nearly half of the backdrop were either underwater or nearly so. Compared with white neighborhoods, these borrowers were twice as likely to have trivial or no equity in their homes at the cease of 2011.10

However, 46,000 low-income owners had a very different feel with affordable, sustainable mortgages underwritten by the Community Advantage Program (CAP). CAP, a articulation community reinvestment programme initiative by the Heart for Customs Self-Help, the Ford Foundation, and Fannie Mae, makes secondary market majuscule accessible to low-income and minority borrowers. With carefully underwritten loans, these borrowers were able to build wealth fifty-fifty during tough economic times. CAP loans are always thirty-year, fixed-rate mortgages underwritten with a household's income and ability to sustain homeownership in mind and serviced proactively to help troubled borrowers.11 But 9 percent of these loans were seriously delinquent in the latter role of 2011 compared with 15 percent of prime adjustable-rate mortgages, xx percentage of subprime fixed-rate mortgages, and 36 percent of subprime adjustable-rate mortgages.12 From the origination date of their loans through mid-2011, CAP owners "realized a median annualized return on their equity of 27 percent."

Fiscal gain is not the merely reason a majority of American households aspire to own a dwelling house; social benefits are as well associated with homeownership. In a recently released National Housing Survey sponsored by Fannie Mae, the about cited reasons for wanting to own a habitation were to have a skillful place to enhance children, a safe place to alive, more space for family unit, and command over one'south living space.thirteen Herbert and Belsky found that the nonfinancial benefits associated with homeownership, which have been linked to improve physical and psychological health, are evident but not assured.14 Some of these benefits pertain to greater satisfaction — with life, 1'southward home, and i's neighborhood. In a comparing of attitudes about homeownership held by renters and owners, Harris Interactive (for the National Association of Realtors) constitute owners more than satisfied with most aspects of their customs, including access to the outdoors and natural resources, healthcare, shopping, educational opportunity, entertainment, arts and culture, transportation, and a family unit-oriented environment. Homeowners viewed their communities every bit stronger, safer, and more than stable than did renters and were more probable to report that they felt continued to others, knew their neighbors, and were civically engaged.15 In a unlike written report, CAP owners, when compared with a group of matched renters, likewise were found to take more social ties leading to increased social interaction and involvement, a greater sense of existence able to command important aspects of their lives and resolve issues, and less overall stress post-obit the fiscal crisis despite having experienced similar levels of financial stress and hardship.xvi

Although William Rohe and Roberto Quercia also found that owners were more satisfied with life and had larger social networks than the renters with whom they were compared, they did not detect that "participation in voluntary associations, neighborhood satisfaction, self-esteem, or perceptions of opportunity" were significantly related to homeownership. They hypothesized that low-income and college-income buyers may experience the impact of homebuying differently, that the impacts of ownership are realized over time, and that methods used for measuring those impacts may be inadequate.17

Homeowners such equally Aishon Jones, standing in front end of her new home in Syracuse, New York, seek the economical and social benefits associated with successful homeownership. NeighborWorks America Other positive effects identified with homeownership include improved outcomes for children. Researchers have not nonetheless determined whether such outcomes can exist attributed directly to homeownership, the stability it invokes, unidentified or uncontrolled variables, particular research methods, or selection bias (in which the children would have realized similar benefits regardless of whether their parents accomplished homeownership).18 Notwithstanding, homeownership has been associated with outcomes such as educational attainment (longer stays in school, college graduation rates, greater likelihood of achieving postsecondary teaching, improved math and reading scores), ameliorate employment and earnings opportunities, and fewer behavioral problems.xix Recent studies indicate that if homeownership has positive effects on the wellness and well-being of parents, their children are more likely to do good from having healthier, engaged parents also as from fiscal grooming.20 One investigation constitute that homeownership was strongly associated with the incidence of very skillful or splendid child health, but the relationship too depended on the household'south resources.21 A new study revisiting the question of homeownership'due south impact on children concludes that the dropout rate for children in owner-occupied homes was 2.6 percent lower — and the teen nativity rate 5 percentage lower — than for children in rental households. Findings too indicate that when borrowers brand some investment in the down payment, no matter how small, the result is better outcomes for their children than when they put none of their own money downwardly.22

Despite its potential benefits, notwithstanding, homeownership is a take chances, and its outcomes may be neither anticipated nor desired. If a homeowner has too much house to pay for, does non refinance to take advantage of interest charge per unit declines, experiences unanticipated repairs or trigger events (such as a divorce or medical emergency), has a dwelling house that declines in value or appreciates very slowly, or has a mortgage with predatory terms, then buying is hard to sustain.23 In 2004 and 2006, HUD studies found a high probability that half of lower-income and minority families return to renting inside five years of a home buy, due to unemployment or a turn down in earnings, mortgage rate changes, housing cost burdens, or other trigger events.24 More recently, Van Zandt and Rohe plant that the housing market place crisis left a sizable number of low-income homeowners at gamble of being unable to sustain buying after just ii years due to unexpected costs and needed habitation repairs.25

Historically, disparities take existed in access to homeownership past low-income and minority households. The factors that shape, impede, or facilitate homeownership opportunities for these households have been the subject of substantial enquiry, including studies commissioned by HUD'due south Role of Policy Development and Research in the early on to mid-2000s. One focus of these inquiries, arising from concerns nearly fairness and discrimination, has been differences in homeownership rates beyond income and racial or ethnic groups (effigy 1). The persistence of these disparities, co-ordinate to a body of related enquiry, suggests that demographic and economic factors play a meaning role in shaping homeownership trends. Analyses of the composition of the homeownership gap have concluded that socioeconomic variables explain a large per centum of the divergence, leaving a smaller portion attributable to discrimination and unidentified influences.26

Source: U.S. Demography Bureau, Housing Vacancy Surveys and Current Population Survey, Annual Social and Economic Supplements. Homeownership rates are highest for older households, married couples, and those with more instruction. These characteristics are related to income and influence homeownership decisions differently across income levels.27 Homeownership decisions are besides shaped by patterns of household formation that differ past economic, demographic, and social circumstances. Typical factors that affect household formation include racial and ethnic differences, historic period structure of the population, marriage and divorce patterns, typical leaving-home ages, the cost of living, housing costs, and living in group quarters for armed services or educational purposes.28

Along with income, household wealth determines whether families can afford downwards payment and closing costs and can sustain homeownership after purchase. In a 2004 study deputed by HUD, minorities and whites at similar income levels were equally likely to go homeowners, but wealth was a better predictor of minority transition to homeownership. Minority households required higher levels of wealth to achieve the same probability of homeownership equally white households had, all other things being equal. Wealth gaps were evident across ethnic and racial groups. In one example, found by examining measures of wealth among renters, a large share of blackness and Hispanic renters had so little wealth that nix-downward payment loans were the only mortgage option bachelor to them. The cyberspace worth of white households at the 50th percentile level of wealth was roughly equivalent to the net worth of black and Hispanic households at the 75th percentile. In other words, at the 50th percentile level of wealth, white renters had a net worth of $10,000 (in 1998 dollars), only not until the 75th percentile did black renters have a net worth of slightly more than $10,000 and Hispanics accept about $8,500.29

The differential in household wealth continues, according to the Pew Research Center. One-fifth of U.Southward. households had zero or negative internet worth in 2009. Of this group, 35 percent were black households, 31 percent were Hispanic, 19 per centum were Asian, and 15 percentage were white. Excluding abode disinterestedness, median household wealth in 2009 was $29,169 for whites, $20,300 for Asians, $ii,806 for Hispanics, and $i,050 for blacks.30 Therefore, as noted higher up, the decline in cyberspace worth of U.South. households during the recession striking minorities the hardest because they depended more than on dwelling house equity as a source of wealth.

Location and geography also influence homeownership disparities across groups through their consequence on housing supply and demand. Factors such as land prices, regulatory environments, zoning and building codes, population density, and demographic characteristics all touch on potential buyers' power to purchase a home. Cardinal cities, for instance, historically have had lower homeownership rates than suburban areas, partly because homeownership has been associated largely with single-family homes that are less prevalent in cities. As a result, minorities and low-income families concentrated in inner cities have had access to fewer homeownership opportunities.31

Homebuyers and volunteers provide sweat disinterestedness and labor to build Habitat for Humanity homes in Miami, Florida. Victor Antunez Homeownership is in the nation's involvement when information technology tin can bring stability to families, new vitality to distressed communities, and overall economical growth, say experts in the field.32 These -to-be outcomes are why a counterbalanced housing policy that safeguards choice is preferable to promoting homeownership at any cost. Eric Belsky, director of the Joint Center for Housing Studies of Harvard Academy, puts it succinctly: "It's important for society, regulators, and the authorities to ensure that people have the opportunity to buy a home — and then leave [the selection] upwardly to them."33 All the same the barriers to sustainable homeownership for low-income and minority families are powerful: bereft income and household wealth to afford down payment and closing costs, inaccessible or poor credit, lack of cognition about buying a home and sustaining homeownership, regulatory burdens, an insufficient supply of affordable housing, and discrimination.34

Governments, foundations, lending institutions, and community-based organizations have made efforts to address these barriers and to facilitate successful homeownership. Such entities piece of work, ofttimes jointly, to create homeownership opportunities, innovative financing tools, and retention strategies. Janneke Ratcliffe, executive manager of Academy of Northward Carolina's Eye for Community Upper-case letter, explains that these activities tend to fall into one of iii categories: making homeownership affordable, expanding access to condom and audio financing, and preparing potential buyers to be successful homeowners.35 HUD initiatives are a meaning part of this landscape, in which the department concentrates energy and resources on removing barriers and expanding opportunity for low-income and minority homeownership.

Affordability assistance helps depression-income families overcome wealth barriers and achieve favorable debt-to-income ratios that keep monthly payments low. Examples of this blazon of backing include down payment help, grants, subsidies, homeownership vouchers, forgivable loans, and soft 2nd mortgages.

Even small amounts of down payment aid increase the probability of moving first-fourth dimension buyers into homeownership.36 Although about i out of five kickoff-time homebuyers receives such help from their families, low-income households are less likely to take this option bachelor.37 One source of help for these households is the Federal Housing Assistants (FHA), which facilitates first-fourth dimension homeownership for low-wealth buyers. FHA's minimum downwards payment requirement is set at three.5 percentage of the contract sales price. Edward Szymanoski, HUD'due south associate deputy assistant secretary for economic diplomacy, notes that FHA'due south traditional role — serving creditworthy starting time-time homebuyers — is specially important to families with young children, who may do good about from early on access to homeownership. "Kickoff-time buyers oftentimes lack greenbacks to pay the down payment and closing costs charged by conventional lenders and would otherwise have to defer homeownership for many years," Szymanoski says.38

Eligible homebuyers can also obtain help with down payment and endmost costs through the Habitation Investment Partnerships (Dwelling house) and Community Evolution Block Grant (CDBG) programs. Through these programs, HUD awards block grants to cities and states, who then decide how to use the funds. Domicile monies are dedicated to enhancing local affordable housing strategies that increase homeownership opportunities for low-income people. One study found that near all HOME programs offer assistance with down payment and closing costs in addition to other types of support such as loan guarantees, write-downs of the sales price, and interest rate purchase-downs.39

Between 2004 and 2008, the American Dream Downpayment Initiative (now part of HOME) helped more than 26,000 low-income, get-go-time homebuyers with the biggest hurdle to homeownership: down payment and endmost costs, plus rehabilitation expenses. Although the program capped assistance at the larger of $10,000 or 6 pct of the purchase price, the average corporeality was $five,000 per household.40 A 2005 HUD written report ended that small amounts of down payment aid like this tin can be very effective in helping renters become homeowners and that as picayune equally $1,000 tin lead to a 19-per centum increase in the number of depression-income households buying a home. While the size of the increase declines as the level of aid rises, assistance of upward to $10,000 can lead to a 34-percent increase in overall homeownership, although the effect on underserved groups is greater — a 41-pct increase in low-income homeownership.41

Some buyers are able to lower their overall investment with sweat disinterestedness through HUD's Self-Help Homeownership Opportunity Program (SHOP). National and regional nonprofits and consortia receiving Store grantees developed sixteen,957 homeownership housing units for depression-income families between 1996 and 2008. The grants are used to buy state and make infrastructure improvements that cannot exceed an average cost of $15,000 per unit; additional funds for construction or rehabilitation must exist leveraged. Grantees may carry out SHOP activities themselves or contract with nonprofit affiliates to develop SHOP units, select homebuyers, coordinate sweat equity and volunteer efforts, and help arrange for interim and permanent financing for homebuyers. To significantly reduce purchase prices, homebuyers are required to put in a minimum number of hours of sweat equity, including painting, carpentry, trim work, and drywall, covering, and siding installation. Without this sweat disinterestedness contribution, total development costs would range from 0.2 to 14.seven percent higher for each housing unit of measurement, according to an unpublished study by HUD's Office of Policy Development and Research.42

Renters of HUD-assisted units may become homeowners via the Housing Choice Voucher Homeownership program, which has been responsible for nigh 15,000 homeownership closings in the past decade. This plan allows participating public housing agencies to offer residents the selection to apply their rental voucher subsidy toward monthly ownership expenses. Afterwards satisfactorily completing a preassistance counseling plan that covers home maintenance, budgeting and coin management, credit counseling and credit repair, and mortgage financing, the purchaser finds an eligible home. In its analysis, Abt Assembly found that the number of public housing agencies choosing to implement this program grew from 12 airplane pilot sites in 1999 to more 450 in 2006. Foreclosure, delinquency, and default rates were quite low for these buyers, who were mostly single mothers with children, minorities, and people with disabilities moving into neighborhoods with college homeownership rates and slightly lower poverty rates than the neighborhoods where they had rented.43

An alternative form of help to low-income homebuyers, lease-purchase, is bachelor through Dwelling, CDBG, and Housing Option Voucher Homeownership funds. An evaluation of a low-income homeownership program that preceded HOME found that x percent of participating families became owners by leasing to buy. This option immune homebuyers who needed a picayune more time to accrue the savings needed for a down payment or to clear up credit problems while living in the dwelling house they would somewhen purchase. 1 locality used lease-purchase in a transitional housing programme as the final step to help formerly homeless families go homeowners.44

Expanding access to homeownership involves making sound mortgages available to more households through such tools as flexible and culling underwriting guidelines that reduce the risk of homeownership. Examples include CAP's secondary mortgage market program, which has enabled banks effectually the country to help more than 50,000 lower-income families purchase homes. Other examples include vehicles such every bit tax-exempt bonds that state and local governments upshot through housing finance agencies to help fund affordable mortgages for qualifying first-time homebuyers.45

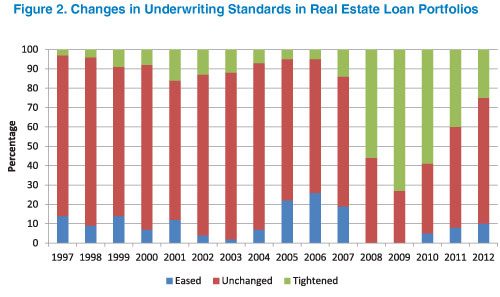

Source: Office of the Comptroller of the Currency Survey of Credit Underwriting Practices.

N = 84 lenders in 2012.HUD'due south largest function in supporting safe and sound lending is through FHA, every bit mentioned in a higher place, which was created in 1934 as a home mortgage insurance program. This insurance supports creditworthy loans with flexible underwriting, all-around lower down payments, and higher payment-to-income ratios while making allowances for weaker credit histories. FHA was the first organization to establish national underwriting standards and has been the simply broadly accessible government guaranty linking mortgage borrowers with the lower-toll credit of mortgage lenders. During the recent precrisis housing boom, FHA remained true to its underwriting standards, which led to a pregnant decline in marketplace share as borrowers sought nontraditional loans elsewhere. Private market products such every bit teaser rates, hybrid adaptable charge per unit mortgages, and negative amortization were ofttimes used to qualify borrowers who would be ineligible under traditional underwriting practices. These nontraditional mortgages, with their college costs and college-risk qualifying advantages, disproportionately went to minorities and depression-income borrowers and clearly were not designed for sustainable homeownership.46

In 2008 and 2009, every bit admission to credit and housing finance became more difficult and the housing crisis worsened, mainstream financial lenders failed to serve low-income borrowers; families with weaker credit histories were increasingly rejected for mortgage credit or canonical for loans with loftier interest rates. When individual capital fled the market and credit tightened (effigy two), HUD Housing Finance Analysis Division economist John Comeau explains, "FHA filled the void to allow homeowners to admission capital and keep housing markets in highly stressed areas from completely shutting downwardly." FHA's market share, which represented just 4.five pct of all home purchase loans in 2005 and 2006, rose to 32.6 percent past 2009.47

FHA makes a disquisitional difference by insuring mortgages for homebuyers, thereby protecting lenders and investors from loss. Because of these safeguards, first-time homebuyers and underserved groups take improve access to sustainable loans.

Housing counseling is another approach to affordable, sustainable homeownership. By providing skillful information and guidance, housing counseling combats the unfamiliarity with homebuying and homeowning processes that make many low-income and minority borrowers vulnerable to predatory lending practices and unprepared for homeownership. The Dodd-Frank Wall Street Reform and Consumer Protection Act, which requires lenders to distribute a list of HUD-approved counseling providers to consumers, specifies the scope of homeownership counseling every bit "the entire process of homeownership, including the decision to purchase a habitation, the selection and purchase of a home, issues arising during or affecting the period of ownership of a home (including refinancing, default and foreclosure, and other financial decisions), and the sale or other disposition of a home."48

Local nonprofits enroll homebuyers in required pre-buy education at an outcome held by Wells Fargo and NeighborWorks America in Twin Cities, Minnesota. NeighborWorks America Since 1968, HUD has provided grants to nearly 500 local, regional, and national organizations for housing counseling programs that assist consumers find, finance, maintain, rent, or ain a home. HUD-approved counseling agencies also aid families manage money and evaluate their readiness for a home purchase. Moulton et al. recently investigated the perceptions that first-time, low-income homebuyers have about their ability to presume mortgage debt. Nearly i-4th of the written report participants underestimated their ain debt-to-income constraints, a perception associated with taking on more mortgage debt than they might if their estimates were accurate. This finding suggests that borrowers could benefit from a improve understanding of their personal fiscal situation.49 These researchers also found that perceptions drive participation in counseling; borrowers who overestimate their debt are more likely to become financial counseling than those who are overconfident near their ability to repay debt (and almost in need of counseling).

When clients decide to purchase a abode, counselors assist borrowers in navigating the homebuying process, reviewing the loan documentation to avoid mortgage fraud, loftier involvement rates, inflated appraisals, unaffordable repayment terms, and other conditions that lead to loss of equity, increased debt, default, and foreclosure. Foreclosure prevention counseling helps homeowners facing delinquency or default with expense reduction, negotiations with lenders and loan servicers, and loss mitigation. Subsequently 2005, the need for counseling to aid with mortgage delinquencies, refinancing, and opposite mortgages began to climb. Between financial years 2006 and 2007, the number of clients receiving foreclosure mitigation counseling increased by 55 percentage. Counseling for homeowners on home maintenance or financial management as well grew by 22 per centum in 2007, reflecting the economic downturn and housing crisis. The total number receiving housing counseling in 2007 reached 1.vii million.fifty HUD's and Treasury's latest Housing Scorecard study indicates that 8.5 million borrowers have met with HUD-approved housing counselors since April 2009.51

Two studies deputed by HUD were released in early on 2012 on the outcomes of counseling — on prepurchase counseling and on foreclosure counseling. Ane important role of prepurchase counseling is to place potential buyers who are not yet ready for homeownership and advise them on how to lower their risk of default before they use for a mortgage. The results of the first inquiry report found that inside eighteen months of seeking homebuyer aid, help with down payment or closing costs, or eligibility for a specific loan programme, 35 per centum of study participants had become homeowners. The second investigation reviewed the experiences of a grouping of homeowners who received foreclosure mitigation services in 2009. These homeowners were more likely than U.South. homeowners in general to be members of a racial or ethnic minority, have below-boilerplate annual incomes, and have fallen behind on their mortgages because of a loss of income; few had savings to cover missed payments. Near had contacted their lender when they offset savage behind on mortgage payments but were unsuccessful in negotiating remedies. With counseling, 69 percent obtained a mortgage remedy and 56 percent were able to get current on their mortgages. Clients who sought help before becoming runaway fared improve than those who got help after falling half dozen months or more behind on payments.52 "These studies," explains Marina Fifty. Myhre, social science annotator in HUD's Office of Policy Evolution and Research, "don't stand for all prepurchase or foreclosure counseling clients, of course, just the alignment of these findings with other housing counseling studies underscores the effectiveness of housing counseling and the of import role it plays in helping families achieve and sustain homeownership."53

These efforts to facilitate entry, affordability, and success for starting time time, low-income, and minority homeowners are shortly beingness weighed in light of protecting the recovery and time to come health of the housing market and the economy.

A volunteer contributes labor on a Southern Maryland Tri-county Customs Action group Self-Help work twenty-four hours. Housing Assistance Council Unremarkably, the secondary mortgage market has routed funds to borrowers by facilitating the resale of mortgages and mortgage-backed securities to purchasers such as Fannie Mae, Freddie Mac, and other financial institutions and investor conduits, creating market place liquidity.54 In the aftermath of the housing crisis, investors have remained cautious and private uppercase has been ho-hum to return to the mortgage market. Although FHA, Fannie Mae, Freddie Mac, and Ginnie Mae currently back more than than 90 percentage of new mortgages and therefore accept mitigated some of the stress in the mortgage market, HUD Secretary Shaun Donovan explained that this rate is "far college than nosotros would like in normal times."55

In deciding how to reform and regulate the housing finance system, policymakers seek a balanced approach that makes homeownership possible without putting either borrowers or lenders at undue hazard of failure. Ongoing discussions seek the appropriate form of government involvement in providing federal mortgage insurance, regulatory oversight, and protection from bigotry that is essential to maintain confidence in the market, likewise as to safeguard lending to depression-income and minority borrowers.56 Many stakeholders in these reforms accept voiced opinions almost how the new housing finance arrangement should work and what information technology should reach. The Middle for American Progress has collected, analyzed, and posted 21 recommended reform plans from different interested parties on its website for reference and comparing. The Heart's analysis suggests that virtually plans have at least 3 objectives: a government guarantee that is clear and limited in its telescopic, a larger role for private capital, and skilful authorities oversight.57

Although early on signs of a housing recovery are present, that recovery is significantly constrained by a backlog of foreclosures and vacant units held off the market, an overall loss of housing wealth, unemployment, restricted lending to those without high credit scores, minimal upper-case letter for a secondary mortgage marketplace, and precarious family finances. The return of private majuscule and liquidity to the secondary mortgage market place is a loftier priority. "A fundamental lesson from this crisis," states Secretary Donovan, "is that decisions made in the secondary market very clearly drive lending practices in the main market — and the potential for disparate bear upon in the availability and quality of mortgages in underserved communities is very existent."58 Because the housing market place remains frail, it volition take time and thought to develop reforms that provide access to mortgages for creditworthy depression-income and minority families while also reducing adventure and increasing protection for consumers, investors, and taxpayers. These outcomes are vital to sustainable homeownership for millions of Americans and are fundamental to the overall health of the economy.

- A severely housing cost-burdened household pays more one-half of its income on housing costs. Laura Williams. 2012. "An Annual Wait at the Housing Affordability Challenges of America's Working Households," Housing Landscape 2012, Middle for Housing Policy.

- Christopher E. Herbert, Eric S. Belsky, and William C. Apgar. 2012. "Disquisitional Housing Finance Challenges for Policymakers: Defining a Research Agenda," Joint Heart for Housing Studies of Harvard University.

- Christian Due east. Weller. 2007. "Access Denied: Low-Income and Minority Families Face More than Credit Constraints and Higher Borrowing Costs," Center for American Progress; Jesse Bricker, Arthur B. Kennickell, Kevin B. Moore, and John Sabelhaus. 2012. "Changes in U.Due south. Family Finances from 2007 to 2010: Evidence from the Survey of Consumer Finances," Federal Reserve Message 98:two, 69; Carolina Reid, David Min, and Janneke Ratcliffe. 2012. "Affordable Housing: The Mode Forward From Here," Center for Responsible Lending, Eye for American Progress, and University of North Carolina Center for Community Capital.

- George C. Galster and Anna M. Santiago. 2008. "Low-Income Homeownership every bit an Asset-Edifice Tool: What Tin We Tell Policymakers?" in H. Wolman and Thou.A. Turner, eds., Urban and Regional Policy and its Furnishings, Washington DC: Brookings Establishment Press, 66–71.

- Herbert, Belsky, and Apgar; Pew Research Centre. 2011. "Wealth Gaps Rise to Record Highs Between Whites, Blacks and Hispanics," 25.

- Alan Mallach. 2011. "Building Sustainable Buying: Rethinking Public Policy Toward Lower-Income Homeownership," Federal Reserve Banking company of Philadelphia, nineteen.

- Galster and Santiago, 62.

- Christopher East. Herbert and Eric S. Belsky. 2008. "The Homeownership Experience of Depression-Income and Minority Households: A Review and Synthesis of the Literature," Cityscape ten:two, vii–9.

- The Joint Heart for Housing Studies of Harvard University. 2012. "The State of the Nation'due south Housing," xiv.

- Spencer Cowan and Katie Buitrago. 2012. "Struggling to Stay Adrift: Negative Equity in Communities of Color in the Chicago Half-dozen Canton Region," Woodstock Establish.

- Robert G. Quercia, Allison Freeman, and Janneke Ratcliffe. 2011. Regaining the Dream: How to Renew the Promise of Homeownership for America's Working Families, Washington DC: Brookings Institution Printing, 26–9, 82–4.

- Allison Freeman and Janneke Ratcliffe. 2012. "Setting the Record Straight on Affordable Homeownership," Heart for Community Majuscule, University of North Carolina at Chapel Colina, 3.

- Fannie Mae. 2012. "National Housing Survey: Time to come of Homeownership: Own-Rent Analysis, fifteen;" Rachel Bogardus Drew and Christopher Herbert. 2012. "Mail-Recession Drivers of Preferences for Homeownership," Joint Heart for Housing Studies of Harvard University.

- Herbert and Belsky 2008, 9–x.

- National Association of Realtors. 2011. "American Attitudes Virtually Homeownership," 20–half dozen.

- Kim Manturuk, Marker Lindblad, and Roberto Quercia. 2009. "Friends and Neighbors: Homeownership and Social Capital amid Depression-to Moderate-Income Families" and "Homeownership and Sense of Control During Economic Recession" (2010), Eye for Community Capital at the University of Due north Carolina at Chapel Loma; Kim Manturuk, Sara Riley, and Janneke Ratcliffe. 2012. "Perception vs. reality: The relationship betwixt low-income homeownership, perceived financial stress, and financial hardship," Social Scientific discipline Research 41, 276–86.

- William M. Rohe and Roberto G. Quercia. 2003. "Private and Neighborhood Impacts of Neighborhood Reinvestment'due south Homeownership Pilot Program (website content has inverse and this document is no longer available)," The Center for Urban and Regional Studies, Academy of Northward Carolina at Chapel Colina.

- David Barker and Eric Miller. 2009. "Homeownership and Child Welfare," Existent Manor Economics 37:2, 279–303; Lisa L. Mohanty and Lakshmi K. Raut. 2009. "Homeownership and School Outcomes of Children: Evidence from PSID Child Supplement Data," American Journal of Economics and Sociology 68:2, 465–89.

- Richard K. Green and Michelle J. White. 1997. "Measuring the Benefits of Homeowning: Effects on Children," Periodical of Urban Economics 41: 441–61; Herbert and Belsky 2008, 42–seven; Thomas P. Boehm and Alan One thousand. Schlottmann. 1999. "Does Dwelling Ownership past Parents Have an Economic Impact on Their Children?" Journal of Housing Economics eight:iii, 217–32; Donald R. Haurin, Toby 50. Parcel, and R. Jean Haurin. 2001."The Touch on of Homeownership on Child Outcomes," Joint Centre for Housing Studies of Harvard Academy.

- Michal Grinstein-Weiss, Trina R. Williams Shanks, Kim R. Manturuk, Clinton C. Key, Jong-Gyu Paik, and Johann Yard. P. Greeson. 2010."Homeownership and parenting practices: Bear witness from the community advantage panel," Children and Youth Services Review 32:5, 774–82; Michal Grinstein-Weiss, Jonathan Spader, Yeong Hun Yeo, Andréa Taylor, and Elizabeth Books Freeze. 2011. "Parental transfer of financial knowledge and later credit outcomes among low- and moderate-income homeowners," Children and Youth Services Review 33:ane, 78–85.

- Nandinee K. Kutty. 2008. "Using the Making Connections Survey Information to Analyze Housing Mobility and Child Outcomes amid Low-Income Families," Center for Housing Policy, 55.

- Richard K. Greenish, Gary D. Painter, and Michelle J. White. 2012. "Measuring the Benefits of Homeowning: Furnishings on Children Redux," Research Institute for Housing America.

- Galster and Santiago, 63.

- Christopher Due east. Herbert and Eric S. Belsky. 2006. "The Homeownership Experience of Depression-Income and Minority Families, U.S. Section of Housing and Urban Development, 50–four; Thomas P. Boehm and Alan Schlottmann. 2004. "Wealth Accumulation and Homeownership: Evidence for Low-Income Households," U.S. Department of Housing and Urban Development.

- Shannon Van Zandt and William M. Rohe. 2011. "The sustainability of low-income homeownership; the incidence of unexpected costs and needed repairs among low-income home buyers," Housing Policy Debate 21:2, 317–41.

- Christopher E. Herbert, Donald R. Haurin, Stuart S. Rosenthal, and Marker Duda. 2005. "Homeownership Gaps Amidst Low-Income and Minority Borrowers and Neighborhoods," U.S. Section of Housing and Urban Evolution, 141–43.

- Ibid.; Eric Fesselmeyer, Kien T. Le, and Kiat Ying Seah. 2012. "A household-level decomposition of the white-black homeownership gap," Regional Science and Urban Economics 42:1–ii, 58; R.Westward. Bostic and B. J. Surrette. 2001. "Have the Doors Opened Wider? Trends in Family unit Homeownership Rates by Race and Income," Journal of Real Estate Finance and Economics 23:3, 411–34.

- Donald R. Haurin and Stuart S. Rosenthal. 2004. "The Influence of Household Germination on Homeownership Rates Across Time and Race," U.South. Department of Housing and Urban Development; Herbert, Haurin, Rosenthal, and Duda, 29–33.

- Herbert, Haurin, Rosenthal, and Duda, 78.

- Pew Research Centre. 13, 15, sixteen.

- Herbert, Haurin, Rosenthal, and Duda, 115, 142.

- Bipartisan Millennial Housing Commission. 2002. "Meeting Our Nation's Housing Challenges." Washington, DC.

- Interview with Eric Belsky, Baronial 2012.

- U.S. Department of Housing and Urban Development. 2010. "Barriers to Minority Homeownership."

- Interview with Janneke Ratcliffe, September 2012.

- Christopher Due east. Herbert and Winnie Tsen. 2007. "The Potential of Downpayment Assistance for Increasing Homeownership Amongst Minority and Low-Income Households," Cityscape 9:2, 153–83.

- Sondra Beverly, Michael Sherraden, Min Zhan, Trina R. Williams Shanks, Yunju Nam, and Reid Cramer. 2008. "Determinants of Asset Building," 24; Herbert, Belsky, and Apgar.

- Interview with Edward J. Szymanoski, Baronial 2012.

- Jennifer Turnham, Christopher Herbert, Sandra Nolden, Judith Feins, and Jessica Bonjorni. 2004. "Study of Homebuyer Activity through the Dwelling Investment Partnerships Program," U.S. Department of Housing and Urban Evolution; U.South. Department of Housing and Urban Development, Function of Customs Planning and Development. 2001. HOMEfires 3:seven. Accessed 26 July 2012; Mercedes Márquez. 2012. "The HOME Investment Partnerships Programme (Habitation)," Rural Voices 17:1, 16–22; U.S. Section of Housing and Urban Development, Office of Community Planning and Development. 2012. "Home Investment Partnerships Program 2012 Summary Statement and Initiatives."

- ExpectMore.gov: American Dream Downpayment Initiative. Accessed 1 November 2012.

- Christopher E. Herbert and Winnie Tsen. 2005. "The Potential of Downpayment Assistance for Increasing Homeownership Among Minority and Low-Income Households," U.S. Department of Housing and Urban Development.

- U.South. Department of Housing and Urban Evolution. 2005. A Guide to Using Self-Assist Homeownership Opportunity Plan Funds, 1.two–one.4, 2–19, iii.i–iii.24 and an unpublished written report conducted in 2008 by the Part of Policy Development and Research.

- U.Due south. Department of Housing and Urban Evolution. 2006. "Voucher Homeownership Study," Washington, DC.

- U.Southward. Department of Housing and Urban Evolution. 1996. "Evaluation of the HOPE 3 Program: Final Report," Washington, DC.

- Interview with Janneke Ratcliffe.

- William Reeder and John Comeau. 2008. "Using HMDA and Income Leverage to Examine Current Mortgage Market Turmoil," U.Southward. Housing Market Conditions Study, 2nd Quarter 2008, 4–13.

- U.S. Department of Housing and Urban Development. 2012. "Showroom 16. FHA Market Share of 1- to four-Family Mortgages: 2001–Nowadays," U.S. Housing Marketplace Weather Study, 1st Quarter 2012, 76; Interview with John Comeau, Baronial 2012. For a more detailed discussion of FHA's response to the housing crisis and its impact on the FHA insurance fund, come across U.South. Section of Housing and Urban Evolution. 2012. "FY 2012 Almanac Written report to Congress on FHA Unmarried-Family unit Mutual Mortgage Insurance Fund Programs."

- Dodd-Frank Wall Street Reform and Consumer Protection Act, Public Police force 111-203, 21 July 2010.

- Stephanie Moulton, Cäzilia Loibl, J. Michael Collins, and Anya Savikhin. 2012. "Edifice Assets or Building Debt? Do Start Time Homebuyers Know the Difference and Does It Affair? Working draft."

- Christopher E. Herbert, Jennifer Turnham, and Christopher N. Rodger. 2008. "The State of the Housing Counseling Industry," U.S. Section of Housing and Urban Evolution.

- U.S Department of Housing and Urban Development and U.Due south. Department of the Treasury. 2012. "Monthly Housing Scorecard, November 2012," 4. Accessed 26 November 2012.

- Jennifer Turnham and Anna Jefferson. 2012. "Pre-Buy Counseling Event Study: Research Cursory," U.S. Section of Housing and Urban Development; Anna Jefferson, Jonathan Spader, Jennifer Turnham, and Shawn Moulton. 2012. "Foreclosure Counseling Outcome Written report: Concluding Report," U.S. Department of Housing and Urban Evolution.

- Interview with Marina Myhre, August 2012.

- Congressional Budget Office. 2010. "Fannie Mae, Freddie Mac, and the Federal Function in the Secondary Mortgage Marketplace."

- U.S. Section of the Treasury and U.S. Department of Housing and Urban Development. 2011. "Reforming America'southward Housing Finance Marketplace: A Written report to Congress"; Written testimony of Shaun Donovan, Secretary of U.Southward. Department of Housing and Urban Development, Hearing earlier the Commission on Banking, Housing, and Urban Affairs, U.S. Senate, March xv, 2011.

- Herbert, Belsky, and Apgar; Mallach; Edgar O. Olsen. 2007. "Promoting Homeownership Among Low-Income Households," Opportunity and Buying Projection; Jim Millstein. 2012. "A Blueprint for Housing Finance Reform in America," presented at Woodrow Wilson International Heart for Scholars, Washington, DC, 22 May 2012.

- John Griffith. 2012. "The $five Trillion Question: What Should We Do with Fannie Mae and Freddie Mac? Increasing Private Capital in the Mortgage Market by Winding Down the ii Mortgage Giants," Center for American Progress.

- Written testimony of Shaun Donovan.

Source: https://www.huduser.gov/portal/periodicals/em/fall12/highlight1.html

0 Response to "Help Buying a Home for Low Income Families"

Post a Comment